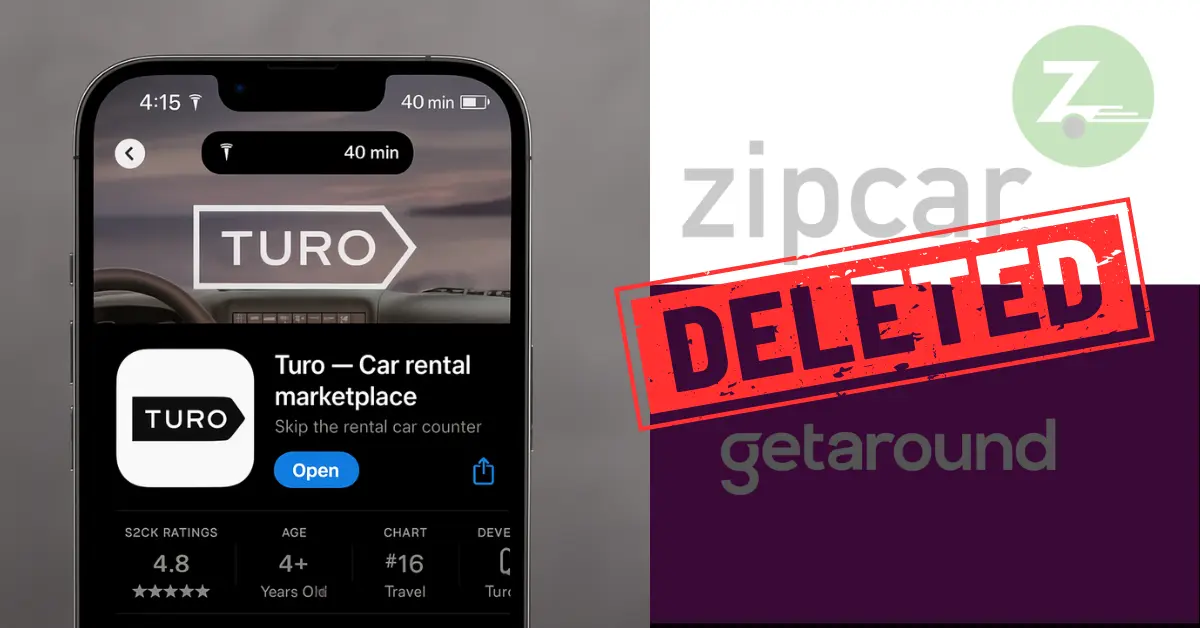

The Truth Behind Why Turo Crushed Getaround and Zipcar

Turo didn’t just outlive its competitors it dismantled them with a strategy built on international demand, host-led expansion, and scalable growth. Here’s how they won the car sharing war.

Introduction

Turo wasn’t the first peer-to-peer car sharing platform. But it was the last one standing. While competitors like Zipcar, Getaround, and HyreCar collapsed under their own weight, Turo didn’t just survive it scaled, adapted, and took over.

This blog breaks down exactly why Turo succeeded and the core strategic decisions that crippled the rest of the market.

The Competitors That Couldn't Keep Up

Zipcar: The Corporate Dinosaur in a Startup Race

Zipcar was a pioneer but that was its curse. The company operated under a fleet-ownership model, requiring infrastructure, maintenance, parking contracts, and asset depreciation.

Once acquired by Avis, innovation slowed. With a rigid tech stack and legacy operations, Zipcar became too heavy to pivot while Turo ran lean.

Getaround: Fast Capital, Slow Execution

Backed by SoftBank and with a valuation over $1.5B at its peak, Getaround expanded recklessly across U.S. and European cities. But they ignored one thing: unit economics.

Their strategy was to own and install hardware in users' cars great on paper, but a logistical and support nightmare in practice. Hosts faced onboarding delays, support black holes, and a lack of community. The company burned through cash and trust equally. After a painful SPAC in 2022, Getaround’s stock plummeted, and restructuring followed.

HyreCar: Wrong Audience, Wrong Risk

HyreCar targeted gig economy drivers Uber and Lyft operators. But this model carried a toxic mix: high-mileage users, low-maintenance standards, and high insurance exposure. They built a platform with razor-thin margins and high operational risk. In 2023, the business collapsed into bankruptcy.

Turo’s Kill Moves: The Strategic Blueprint

1. The International Tourist Funnel

Between 2019 and 2022, Turo launched aggressive ad campaigns outside the U.S., targeting international travelers before they even landed.

While Getaround tried to fight Uber in the same cities, Turo went global. Their goal? Capture tourists looking for a unique experience convertibles in California, Jeeps in Utah, Teslas in Miami. And it worked.

They weren’t selling mobility. They were selling aspiration.

This lifestyle positioning gave Turo higher margins per booking and helped them attract higher-value customers. Unlike Getaround, which emphasized utility and low-cost urban rentals, Turo leaned into aspirational travel experiences offering the same Toyota Corolla at a higher price, not because of the car itself, but because of the context: airport pickup, curated listings, and professional photos that made even basic cars feel like premium options.

2. Community-Led Expansion: Hosts First

Turo didn’t wait for perfect markets. They followed their hosts.

The company built a support system for vehicle owners whether individuals or small rental operators. With fast onboarding, automated pricing tools, and dedicated account support, Turo treated its hosts like partners, not just inventory.

This host-first model triggered viral growth. Hosts recruited other hosts. Facebook groups, YouTube content, and Discord servers became organic onboarding pipelines.

While Getaround was debugging hardware, Turo was onboarding entrepreneurs.

3. No Fleet, No Problem: The Asset-Light Advantage

Turo never bought cars. That’s the game changer.

By using a true P2P model, they avoided fleet depreciation, maintenance costs, and parking logistics. That meant no CapEx. No debt load. No slowdown during economic downturns. It also made them infinitely scalable.

When COVID hit and Hertz sold off 200,000 cars, Turo simply kept growing. Why? Because its vehicles were distributed across individual owners, not held in corporate garages.

4. Operational Leverage During Crisis

In 2021, the rental car industry collapsed under COVID inventory shortages. Turo became the only viable rental option in many U.S. cities.

They didn’t have to buy cars they just incentivized hosts to list more. That flexibility became a turning point: guests discovered the platform out of necessity, then stayed because of the experience.

The Silent Weapon: Trust and Brand Perception

Turo won not just with ads or logistics, but with perception. It looked and felt premium.

- Mobile-first design

- Host profiles with real reviews

- Cars you actually wanted to rent

- No clunky kiosks or key drop-offs

They understood the Airbnb playbook, and they executed it better than anyone in the car space.

Conclusion: Turo Didn't Compete It Escaped

Turo never fought Getaround or Zipcar head-on. It designed a different game, one with better margins, stronger retention, and viral network effects. While other platforms chased riders, Turo empowered owners. While others sold time, Turo sold experience.

That’s why they didn’t just survive the car sharing shakeout. They owned it.

But growth comes with a cost and in Blog 2, we’ll look at how new metrics and operational pressure are now starting to fracture the same community that made Turo great.

FAQ

Q: Why didn’t Turo follow the Uber or Zipcar fleet model?

A: Because it wasn’t scalable. Turo chose an asset-light model powered by hosts, which gave them operational flexibility and low overhead.

Q: How did Getaround fail despite big funding?

A: Poor execution, expensive hardware rollouts, and weak host community support caused its collapse.

Q: Was lifestyle branding really that powerful?

A: Absolutely. Turo turned car rentals into aspirational experiences, especially for tourists. That branding made it a premium platform.

Q: Why did HyreCar’s model fail?

A: Their focus on Uber/Lyft drivers led to high wear-and-tear, insurance issues, and unsustainable margins.

Q: Is Turo still peer-to-peer?

A: Yes. While some rental companies operate on it now, its core model is still powered by individual vehicle owners.