How to Add an LLC to Your Turo Account Step_by_step

Learn how to add an LLC designation to your Turo account, step-by-step. Ensure your business setup is aligned with tax and legal standards.

Understanding Why an LLC Matters for Your Turo Business If you're running your Turo rentals as a serious business, having an LLC (Limited Liability Company) can provide crucial legal and tax benefits. An LLC can help protect your personal assets and simplify tax filings. It also gives your car rental business a more professional appearance when dealing with insurance, clients, and even partners.

An LLC provides a legal separation between your personal finances and your business operations. This means that if your rental business is ever involved in a lawsuit or owes money, your personal assets are not at risk. Additionally, forming an LLC can potentially open up tax advantages depending on how your LLC is structured. Some hosts elect to file taxes as an S corporation, which could offer savings on self employment taxes. Others stick with the default classification for ease and simplicity.

Common Reasons Turo Hosts Form LLCs

- To protect personal assets from liability

- To build business credit for future expansion

- To gain access to commercial insurance options

- To establish professionalism and trust with renters

- To simplify bookkeeping and separate finances

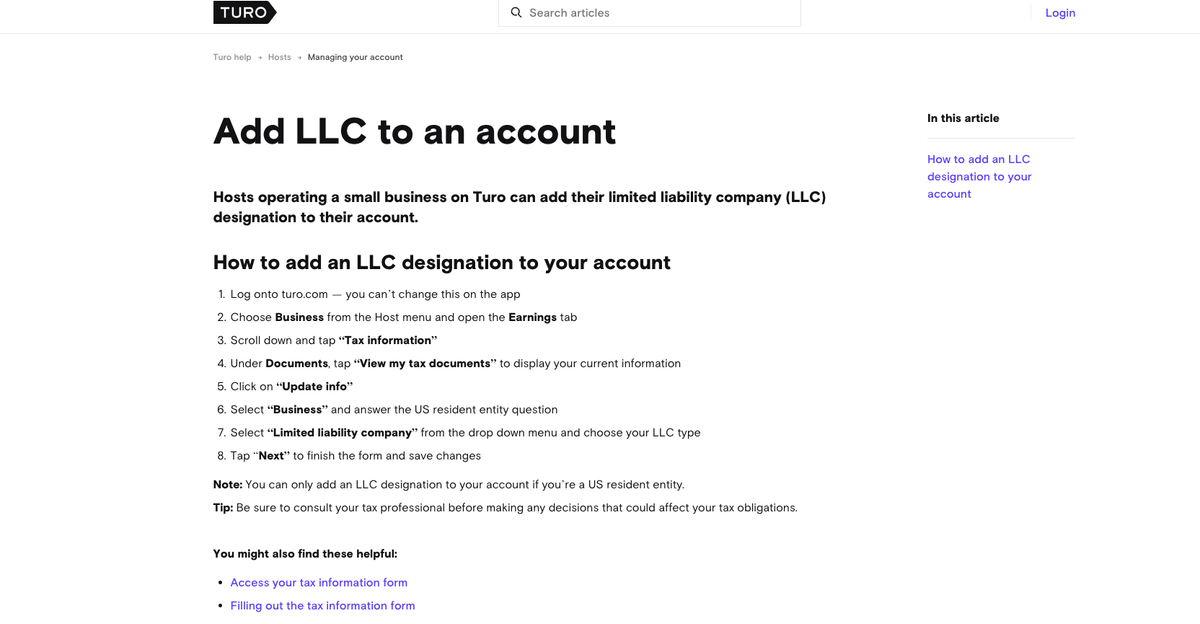

Step-by-Step Guide to Adding an LLC to Your Turo Account

Step 1: Log in to Turo on a Desktop Browser You’ll need to access the Turo website from a desktop browser. The mobile app doesn’t support account structure changes. This is one of the few tasks that Turo intentionally restricts to its full website to avoid errors and to ensure that you’re able to upload and view tax related documents properly.

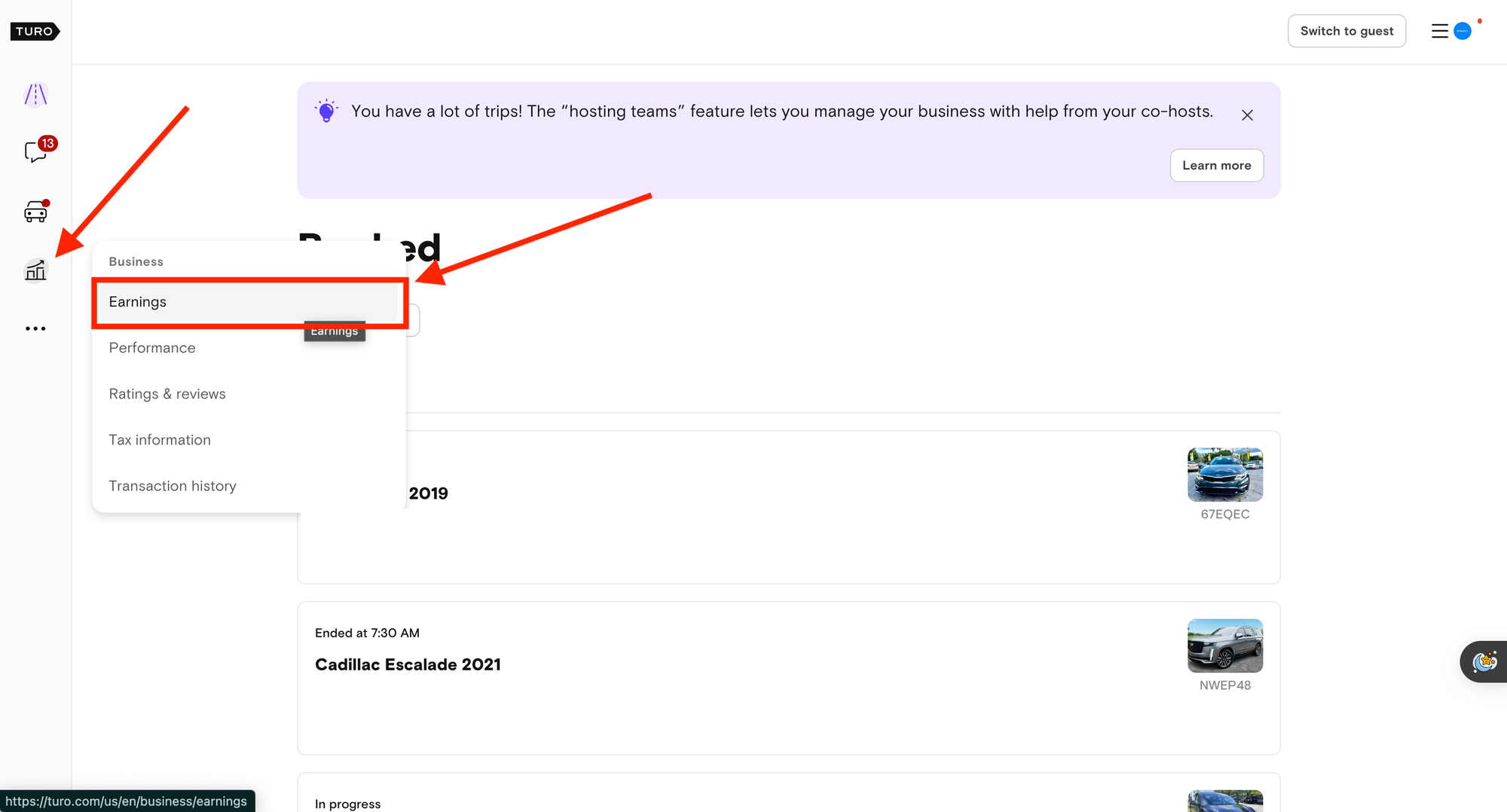

Step 2: Navigate to the Host Dashboard From the main menu, choose Business under the Host section and open the Earnings tab. Here, you’ll find everything related to your rental earnings, taxes, and reporting documents. It’s also the entry point for all business level configurations in your account.

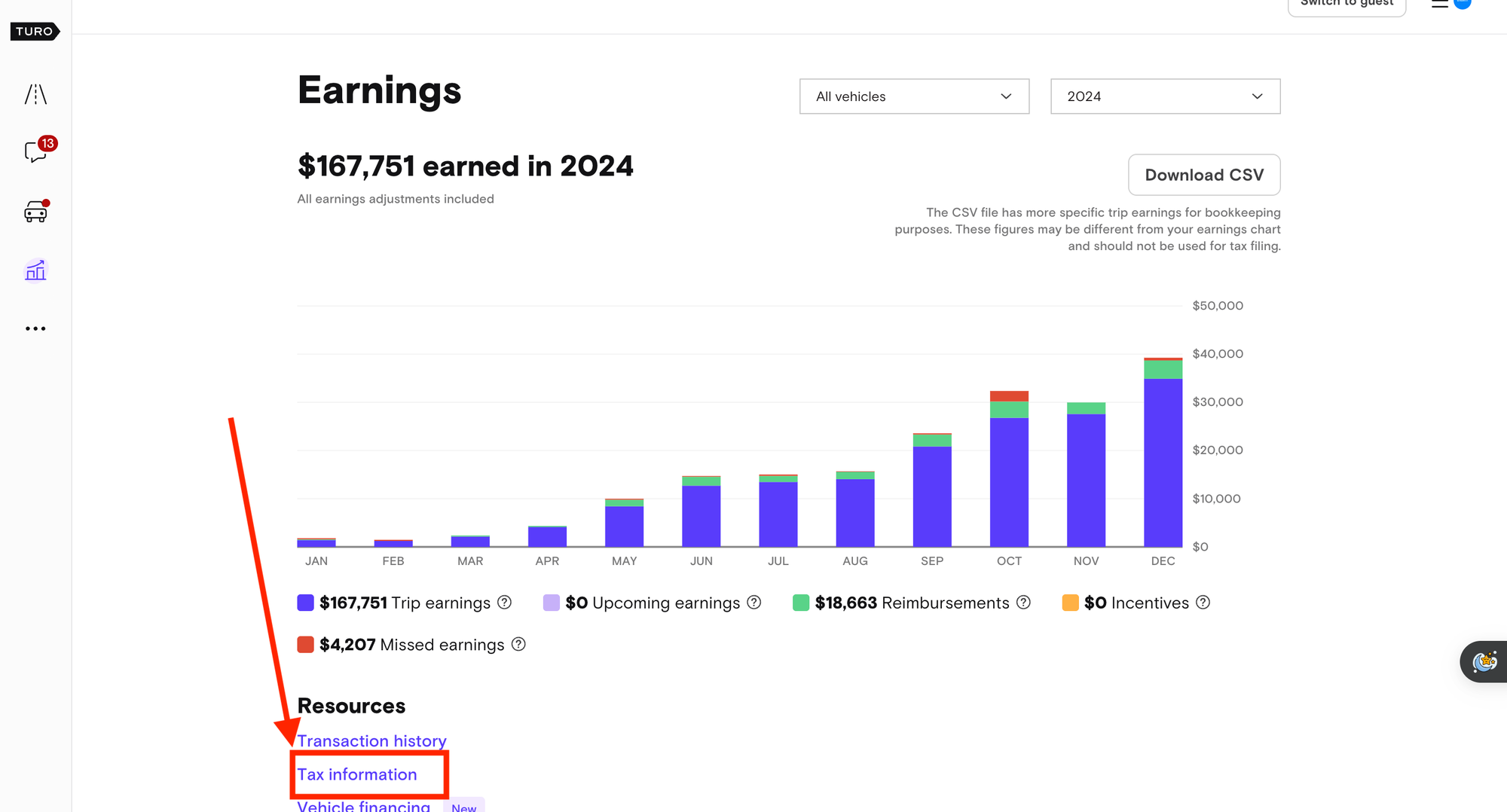

Step 3: Access Tax Information Scroll to the bottom of the Earnings tab and click on Tax information. This section shows you what the IRS and Turo currently have on file regarding your tax status.

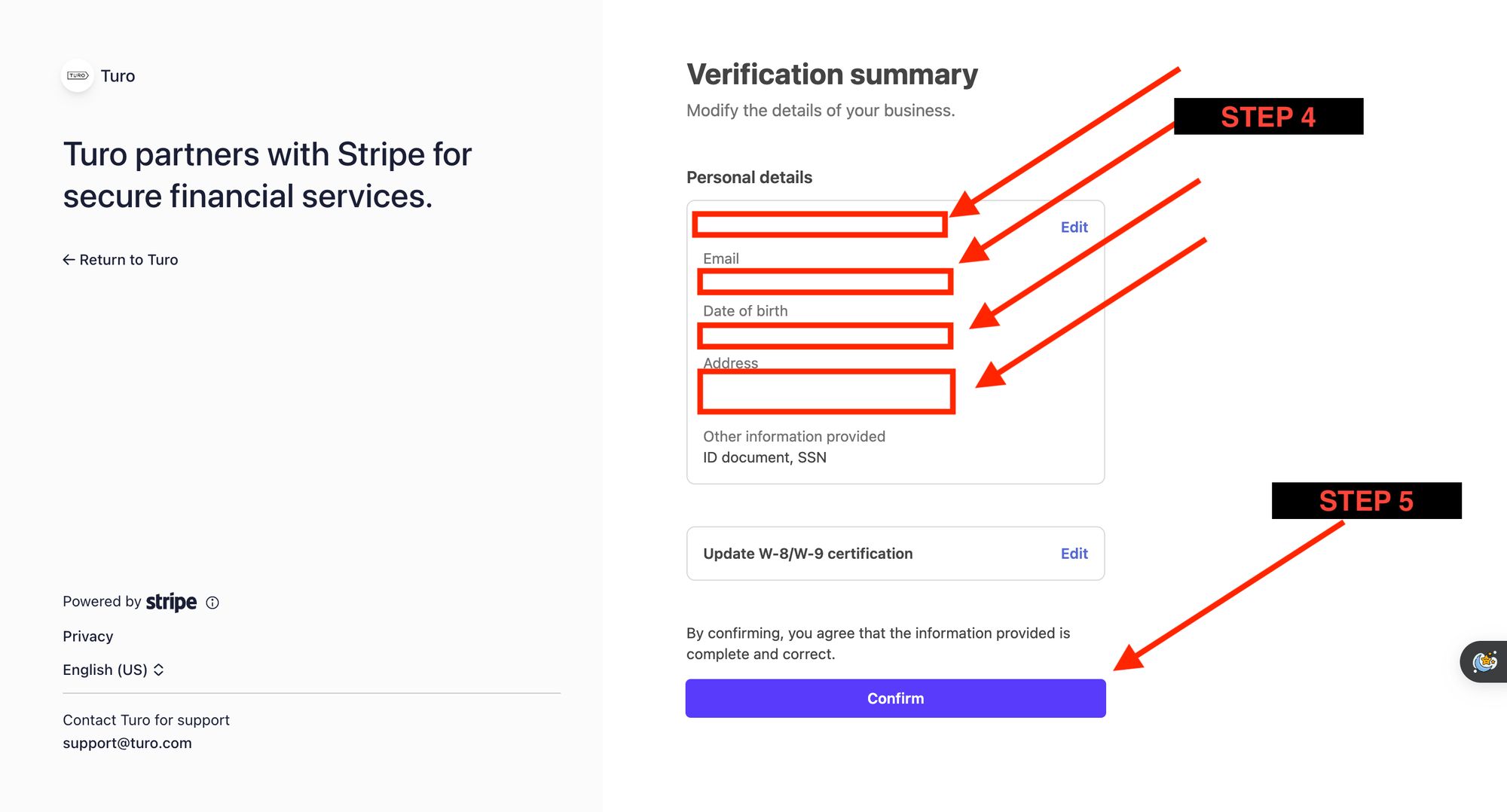

Step 4: View and Edit Your Tax Documents Under the Documents section, click View my tax documents. This will display your current information including your W-9 or other forms that might have been previously submitted.

Step 5: Update Your Info Click on Update info, then:

- Select Business as the account type

- Answer the question about being a U.S. resident entity

- Choose Limited Liability Company from the dropdown

- Select the appropriate LLC type: Single member, Multi member, or Corporation

- Click Next to finish and save changes

Important Note: Only U.S. resident entities are eligible to add LLC designations to Turo accounts. If you're operating internationally, consult with a legal or tax advisor about your options.

Types of LLCs and What They Mean for Turo Hosts

Single-member LLC This is the most common type for solo entrepreneurs. It’s treated as a disregarded entity by the IRS, meaning income is reported on your personal tax return. This structure is easy to manage and provides the protection of an LLC without complicated tax filings.

Multi member LLC If you share your Turo business with a partner or spouse, you may be a multi member LLC. This structure requires more detailed reporting and typically files a separate tax return using Form 1065. Each member receives a K-1 showing their portion of income or loss.

LLC Electing S Corporation Status This is an advanced strategy for Turo hosts making significant income. You may be able to reduce self employment tax obligations. However, this involves stricter compliance and payroll requirements. Always speak to a tax professional if considering this path. (https://www.irs.gov/businesses/small businesses-self employed/s-corporations)

Why You Should Consult a Tax Professional First Before updating your Turo account to an LLC designation, you should consult with a qualified tax advisor. LLCs have unique tax implications that may affect how your income is reported. Having the proper tax classification—whether it’s single member, partnership, or S corp is essential for accurate filings. Tax professionals can help you decide which structure best fits your goals.

How Adding an LLC Impacts Your Turo Experience

Changes in Tax Forms: Once you convert to an LLC, you might start receiving a 1099 NEC instead of a 1099 K, depending on how your LLC is taxed. This can change how you report income and deductions.

Enhanced Documentation: Turo may ask for verification documents such as your Articles of Organization or EIN letter. Be prepared to upload these in your Host Dashboard.

Banking Adjustments: You should consider opening a business bank account under your LLC. This helps keep your business transactions clean and compliant, especially during tax season.

Tips to Ensure a Smooth Transition to LLC on Turo

Double check your EIN: Before submitting your new LLC designation, make sure your Employer Identification Number (EIN) matches the business name exactly as registered.

Keep business and personal expenses separate: This change makes it even more important to separate personal and business financials.

Use a business bank account: Linking a business bank account can streamline financial reporting.

Add your LLC information to other platforms: Be consistent with your LLC designation across any tools or APIs you may be using with Turo.

How Turo Hosts Can Benefit from Legal and Financial Protections

- Limited personal liability in case of disputes, accidents, or business debts

- Increased trust and credibility with renters who may prefer dealing with a registered business

- Potential insurance benefits depending on your state and coverage providers

- Better recordkeeping with structured business income and expenses

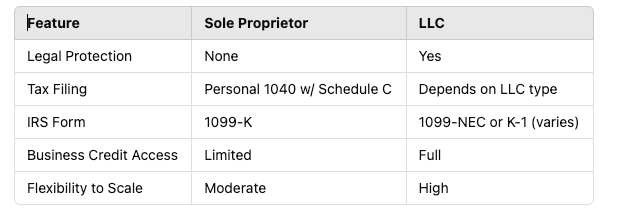

LLC vs. Sole Proprietor for Turo: Key Differences

Conclusion Adding your LLC to your Turo account is a smart move if you're serious about treating your rentals as a business. It adds a layer of professionalism and protection while preparing you for long term growth. Just make sure to consult with a tax advisor, keep your records clean, and follow each step carefully through the Turo desktop website.

FAQs

Can I add an LLC to my Turo account using the mobile app? No. This update can only be made through the desktop version of turo.com.

Do I need to be a U.S. resident to add an LLC? Yes. Only U.S. resident entities can add LLC designations to Turo accounts.

Does Turo require an EIN when switching to LLC? Yes. You’ll need to enter your Employer Identification Number (EIN) during the update.

Is switching to LLC mandatory for Turo hosts? No. It’s optional, but beneficial for hosts operating at a business level.

Will switching to an LLC affect my taxes? Yes. Your tax classification and the forms you receive may change depending on the LLC type you choose. Consult a tax expert.

Do I need to notify Turo support after I update my account? In most cases, no. But Turo may request verification documents to confirm your LLC status.

Can I change back from LLC to individual later? You'll need to contact Turo support if you want to reverse the change. It’s not something you can toggle freely.

What’s the difference between single member and multi member LLC on Turo? Turo allows both types. Single member LLCs are taxed like sole proprietors, while multi member LLCs are usually taxed as partnerships unless otherwise elected.

Is there a deadline for updating to LLC before tax season? There's no set deadline, but doing it before receiving tax documents for the current year is recommended.