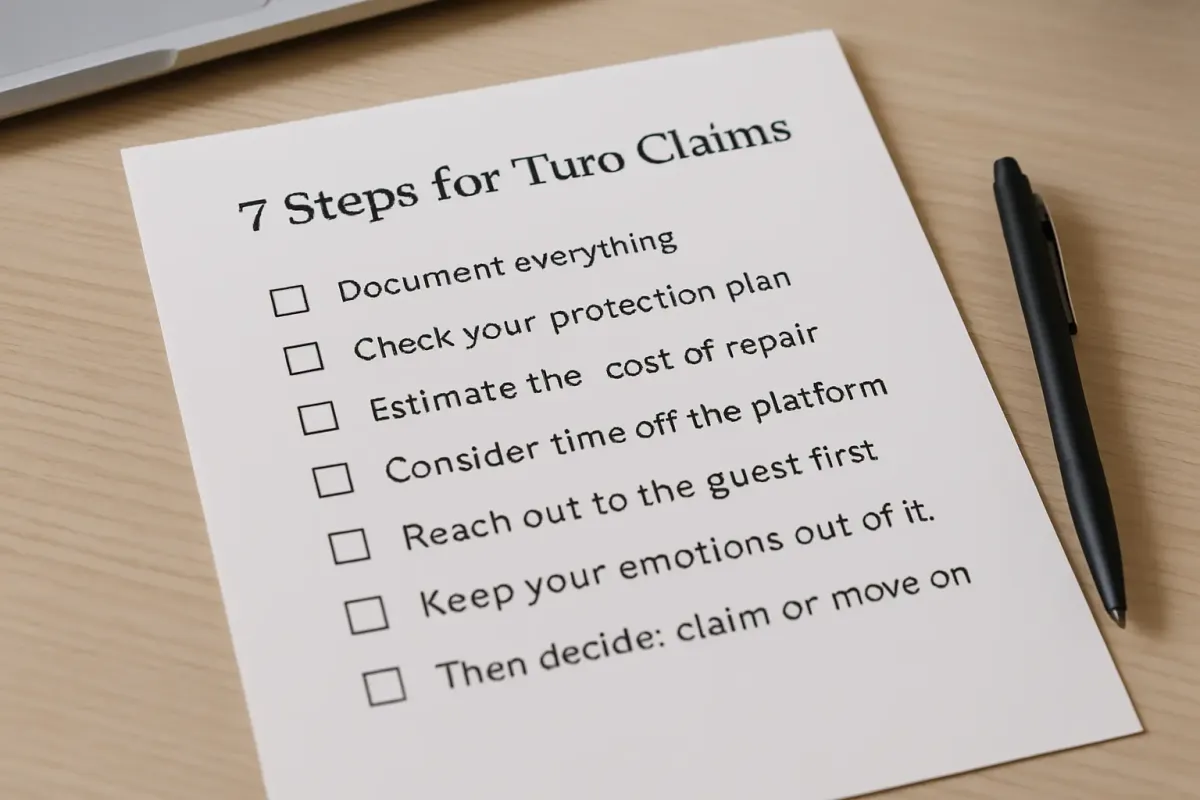

7 Steps to Take Before Opening a Claim on Turo From a Host’s Perspective

Navigating small damages can be tricky for Turo hosts. Learn how to evaluate repair costs, downtime, and communication with guests to maintain a profitable fleet and minimize stress.

Running a Turo fleet is both an opportunity and a responsibility. If you’ve been a Turo host for a while, you likely know how seamless some trips can be and how frustrating it feels when a guest returns your car with a scratch on the bumper, a curbed wheel, or a spilled latte staining the seat. These small damages can be stressful to handle, especially as your fleet grows. The decision to open a claim or absorb the repair cost becomes more than just a passing thought; it’s a crucial aspect of profitability and time management.

In this blog, we’ll explore a proven approach to deciding whether you should open a claim or tackle the damage on your own. At FleetBold, we have experience dealing with hundreds of minor damages. Over time, we’ve refined our process to minimize business disruption and protect your bottom line. Below, you’ll find seven steps you should consider before reaching out to Turo to file a claim. By following these steps, you’ll be better equipped to handle scratches, dents, or even spilled coffee in a way that keeps your operation efficient and rent ready.

Even if small damages appear insignificant, they can add up over time. A single scratch isn’t a big deal, but a series of them throughout the year might collectively impact the look and value of your fleet. The better you manage these issues, the more consistent your listings remain—and consistency is crucial for maintaining top ratings and returning guests. Let’s dive into the detailed steps.

Introduction: Why These 7 Steps Matter

Minor damages are the bane of many Turo hosts’ existence. They often come without warning and can cause needless downtime if not handled properly. There’s more at stake than a simple fix. Each hour your car is out of service, you lose potential revenue. Additionally, opening frequent claims for small issues can slow down administrative processes and even affect guest experiences. Our objective is clear: maximize uptime, minimize lost revenue, and maintain a strong relationship with Turo and your guests.

Below, you’ll discover why each of these 7 steps is key to making smart decisions about repairs. You’ll see real examples that illustrate different points, plus references to relevant Turo resources (https://help.turo.com/) that can help guide you through official policies. By the end of this blog, you should feel comfortable assessing small damages, deciding how to handle them, and ensuring your business keeps thriving.

Section 1: Document Everything

Why Documentation Is Crucial

Small damage isn’t always obvious at first glance. Sometimes, a subtle scratch or scuff goes unnoticed until you’re about to prep the car for its next guest. This is why clear, timestamped photographs and videos are essential. They’re your proof that the damage is new and wasn’t there prior to the rental. If you do decide to file a claim, having rock solid evidence speeds up the process and makes it far less stressful.

How to Document Effectively

- Take Photos Right Away

As soon as the guest returns the car, do a thorough walkaround. Capture wide shots of each panel, then follow with close ups. Make sure you focus on common trouble spots like bumpers, wheels, mirrors, and seats. - Compare Before and After

Maintain a repository of pre trip photos and videos for every trip. Cloud storage solutions or an integrated fleet management system can help. By comparing photos side by side, you’ll highlight fresh damage clearly. - Use Good Lighting

Poorly lit photos can obscure minor scratches or scuffs. If you can, take photos in daylight or a well lit garage. Ensure your camera’s timestamp is accurate. - Video Walkthrough

Many hosts now do a video walkaround. A quick 360 degree walkthrough, plus a look at the interior, can reveal issues that photos alone might miss.

Practical Example

A Tesla comes back with a small door ding on the driver’s side. Immediately upon return, you whip out your phone and snap a series of high resolution pictures of the door’s surface. You also refer to your pre trip photos, taken the previous week, and confirm there was no such ding. By catching it quickly, you avoid confusion, confirm the damage is new, and have definitive evidence if you need to escalate it to Turo.

Conclusion of Section 1

Documentation is the backbone of any claim. Without it, you’re left with hearsay and guesswork. Whether you decide to file or fix the damage yourself, photos and videos keep your operations transparent and trustworthy.

Section 2: Check Your Protection Plan

Understanding Turo’s Deductibles

Turo provides multiple protection plans for hosts, each with a distinct deductible. Common options include the 75 plan with a $250 deductible, the 80 plan with $750, and the 85 or 90 plans with $1,625 or $2,500 deductibles respectively. The higher your deductible, the fewer scenarios in which you’ll benefit from filing a claim for small damage.

Why This Matters

If your repair cost is well below your deductible, a claim won’t help offset any expenses. You’ll pay out of pocket either way, but a claim also requires time and documentation. It might place a temporary hold on your vehicle or prolong the repair process as you wait for approvals.

Real World Example

Let’s say you have scuffs on your rear bumper. A local body shop quotes $320 for a repaint. If you’re on the 80 plan with a $750 deductible, you’re already out $750 if you file a claim, so it makes no financial sense to go through Turo for that amount. Instead, you might choose to pay $320 and get the bumper fixed immediately, freeing the car for its next rental without bureaucratic delays.

Table: Approximate Deductibles vs. Typical Minor Repairs

| Protection Plan | Deductible | Common Minor Repair (avg. cost) | Worth Filing a Claim? |

|---|---|---|---|

| 75 Plan | $250 | $200–$300 | Possibly, if cost > $250 |

| 80 Plan | $750 | $100–$400 | Not usually, unless > $750 |

| 85 Plan | $1,625 | $300–$500 | Rarely, unless very costly |

| 90 Plan | $2,500 | $100–$800 | Almost never for small damage |

Conclusion of Section 2

Knowing your plan’s deductible is critical. This single factor can often determine whether you even consider filing a claim. In many instances, minor damage under $500 is something you’ll handle on your own, especially if you’re on a plan with a high deductible.

Section 3: Estimate the Cost of Repair

The Art of Quick Estimates

Over time, a host develops a good sense of repair costs. You start to know ballpark figures for repairing scratched wheels ($150), windshield chips ($80), or bumper repaints ($300). Having this knowledge avoids guesswork and allows you to make fast decisions.

Where to Get Reliable Estimates

- Local Body Shops

Build relationships with reputable shops. Many will give an estimate if you send them a quick photo and description. - Mobile Repair Services

Mobile dent repair or wheel repair services often come to you. Their estimates might be a bit higher, but they save you time by fixing the car on site. - Online Communities

While it’s best not to rely solely on unverified online claims, you can reference official articles or Turo’s guidelines for typical damages (https://help.turo.com/). Combine that info with your own local data for a clearer picture.

Example

You notice curb rash on a wheel. If you’ve fixed this issue multiple times already, you know your trusted shop charges $125 per wheel. You can get it fixed in 24 hours, so you decide against filing a claim that might lead to more downtime.

Balancing Cost and Downtime

The speed of repair also matters. A shop that charges $150 but gets the job done in one day might be better than one that charges $120 but takes three days. If the vehicle is popular and you have upcoming bookings, those extra days off the platform can cost you more than the difference in repair fees.

Section 4: Consider Time Off the Platform

How Downtime Affects Your Income

Every day your car is waiting for repairs is a day you can’t rent it out. Over a busy weekend, missing out on a single booking might cost you $100–$200. If you stretch that across multiple cars in your fleet, the losses can accumulate.

When a Claim Causes Delays

Filing a claim might require inspection appointments, waiting on adjusters, and scheduling repairs through Turo’s recommended channels. While Turo’s support aims to streamline the process, it’s still not always instantaneous.

A Quick Fix Example

Imagine it’s Thursday afternoon, and your car is booked for a Friday to Sunday rental. The guest has returned it with a cracked side marker light that costs $50 to replace. You can handle that fix yourself in under an hour, preserving the weekend reservation and the revenue that comes with it. Filing a claim in this scenario could mean you lose the weekend booking if the vehicle isn’t swiftly approved for further rentals.

Long Term Fleet Impact

Hosts with multiple vehicles should pay special attention here. A car sitting idle means lost revenue, but it also affects fleet availability and how your profile appears to potential renters. Consistency matters: when all your vehicles are available and in good condition, you capture more bookings overall.

Section 5: Communicate with the Guest First

Why Direct Communication Helps

Most guests don’t want a formal claim on their Turo record. They may be more than willing to pay out of pocket for minor damages to protect their account standing. This direct approach can often be the quickest path to resolution.

How to Approach the Topic

- Send a polite message through the Turo platform with attached photos of the damage.

- Provide a brief but clear explanation of the issue, including an estimate if you already have one.

- If the guest shows willingness, agree on a safe payment method, like Venmo, Cash App, or PayPal. Keep a record of that payment and the receipt for future reference.

Benefit to Both Parties

The guest avoids a possible claim on their record and you avoid the administrative steps of going through Turo’s formal claim process. This also allows for near instant repair if you have the part or service readily available. You preserve the car’s booking schedule, and the guest maintains a cleaner profile.

Respectful Communication

Never confront the guest with blame or anger, no matter how obvious the damage. A calm, professional tone builds trust and makes it more likely the guest will be cooperative. Remember, your overarching goal is to keep your business running smoothly, not to escalate conflicts.

Section 6: Keep Your Emotions Out of It

Why Emotions Don’t Serve You

Damage can feel personal, especially if you’ve invested both money and pride into your vehicle. However, approaching these incidents with anger or frustration often leads to rash decisions. Repair decisions should be based on facts: cost, downtime, and overall profitability.

Reframing Your Mindset

Think of yourself as a small business owner. Even if you just rent out one or two vehicles, you’re running an enterprise. Businesses face wear and tear on assets. The question is how to handle it efficiently, not how to punish the party that caused it.

Example

A guest parallel parks poorly and clips the bumper. You’re annoyed, but a quick $300 repair can resolve it. Filing a claim might tie up the car for a week, costing you more in lost bookings. By staying calm, you realize the cheaper route (in both dollars and time) is to fix it privately and move on.

Benefits of Staying Level Headed

- You maintain a professional reputation.

- Guests are more likely to cooperate.

- You avoid burning mental energy on conflicts that don’t yield profit.

Section 7: Decide: File a Claim or Move On

Bringing It All Together

By now, you’ve documented the damage, confirmed it’s new, assessed repair costs, reviewed your deductible, and even reached out to the guest. This final step is where everything comes together. Do you file a claim, or do you fix it on your own?

When Filing a Claim Makes Sense

- The estimated repair cost is comfortably above your deductible.

- The damage is significant enough to affect the safety or drivability of the vehicle.

- The guest denies responsibility and won’t cooperate with out of pocket repairs.

When You Might Skip the Claim

- The repair cost is below or just around your deductible, so you’d gain little from filing.

- You have immediate bookings lined up and can handle a quick, inexpensive fix.

- The guest is happy to reimburse you directly, and the damage is straightforward to repair.

Real Life Scenario

A cracked taillight costs $180 to replace, and you’re on a plan with a $1,625 deductible. You can fix it the same day, supply the invoice to Turo if needed, and move on with minimal downtime. Filing a claim just isn’t beneficial in this situation.

Conclusion: It’s About Running a Business, Not Chasing Every Claim

Your goal isn’t to capture every dollar of damage; it’s to keep your vehicles active, maintain high guest satisfaction, and safeguard your profitability. Frequent small claims might yield little financial return while creating unnecessary administrative burdens. In many cases, fixing something quickly and moving on is the smartest move.

The beauty of hosting on Turo is that the platform allows you to grow a fleet that meets your financial goals, provided you handle inevitable hiccups wisely. Minor scuffs and spills will happen, but if you follow these seven steps, you’ll be prepared to handle them calmly and efficiently. Over time, you’ll fine tune your approach, possibly building relationships with fast local repair shops or even doing simple repairs yourself.

Remember, the smooth operation of your fleet is the primary focus. The more streamlined you can make your damage resolution process, the less it eats away at your revenue and the better your reviews will be. That’s a winning formula for any Turo host looking to excel in this business.

FAQ

1. How quickly should I report damage to Turo?

You should report any new damage within 24 hours of the trip ending. Turo’s policies (https://help.turo.com/) specify that waiting too long can jeopardize your eligibility for coverage.

2. Can I still get reimbursed for small damages without filing a claim?

Yes, in many instances you can submit a receipt for minor repairs and request reimbursement through Turo. However, it depends on your protection plan and Turo’s current policies. Check official documentation to confirm what’s required.

3. What if the guest denies causing the damage?

That’s where thorough documentation comes in. Timestamped pre trip and post trip photos can prove the damage is new. Turo will review your evidence if a claim is filed.

4. How can I accurately estimate repair costs?

Experience and relationships with local repair shops are key. Keep a log of what different fixes have cost you in the past, so you have a reference point. Over time, you’ll get a sense of typical costs for scratched wheels, minor bumper paint, and upholstery cleaning.

5. Are there specific damages I should always claim?

Major damages—like serious collisions, high cost bodywork, or anything that severely impacts the car’s functionality—usually warrant a claim. If the repair cost comfortably exceeds your deductible, claiming might be the best route.

6. Does frequent claiming hurt my Turo status?

Turo doesn’t explicitly penalize hosts for valid claims, but a host with constant damage reports might raise flags or experience slower approval times. It’s typically better to claim only when it makes financial sense.

7. What if a repair will take several days and I have upcoming bookings?

This is where scheduling and communication become crucial. You could offer the guest a different vehicle in your fleet if available, or reschedule the booking. Alternatively, you might opt for a more expensive but faster repair service, balancing cost against lost bookings.

8. Do I need to disclose minor repairs to future guests?

Minor cosmetic issues often don’t need disclosure unless they affect safety or functionality. However, always be transparent if the condition could impact the guest’s experience.

9. Are there any cleaning tips for minor spills or stains?

Immediate spot cleaning with upholstery friendly products helps a lot. Professional detailing might be necessary if the stain is severe, but often a quick, carefully selected cleaner solves the issue fast.

10. Can I purchase spare parts in advance for quick fixes?

Some hosts keep a small inventory of frequently damaged parts, like side markers or floor mats. It can be a smart move if you know specific parts tend to get damaged often and you want to minimize downtime.